What Does the Rate Cut Mean for Perth Home Prices? Home Buyers & Investors Should Know

Do interest rates push property prices up?

When interest rates decline, we are often asked if they will put upward pressure on property prices.

As seen in The West Real Estate

The Reserve Bank of Australia (RBA) cut interest rates by 0.25 per cent at its last meeting. This will provide welcome relief to mortgage holders and help home buyers trying to enter the market. It may also have some benefit for rental supply. Investors are very focused on yield and the reduction will boost investor sentiment.

This is good news. However, when rates decline, we are often asked if they will put upward pressure on property prices.

The RBA says it can take one to two years for changes to interest rates to affect the economy. One or two cuts on their own will have little immediate impact on the market, but a rate-cutting cycle eventually will.

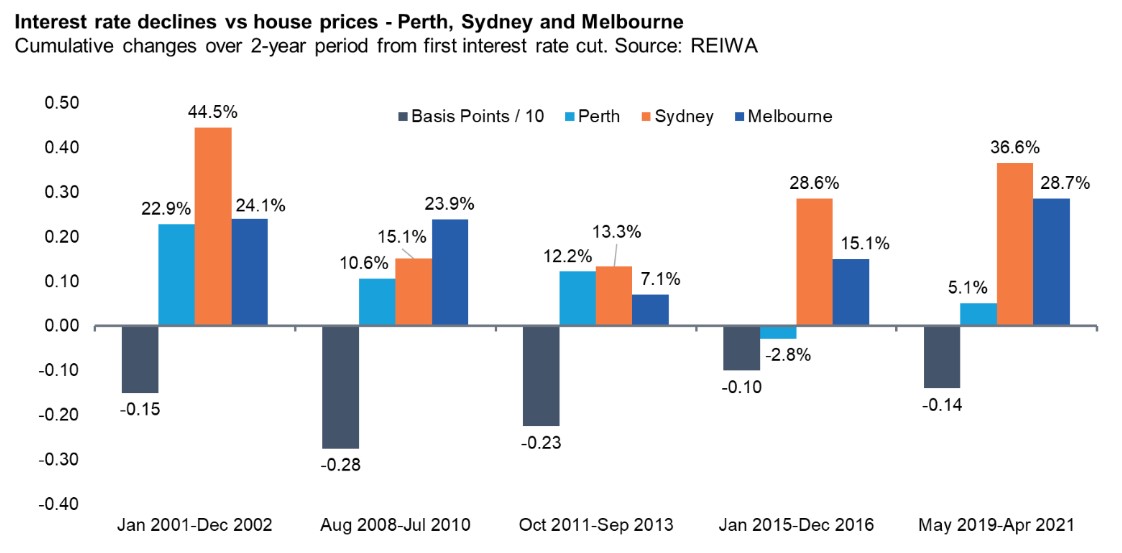

In the past 25 years there have been five rate-cutting cycles. Perth property prices rose after four of them. Our market has been less responsive to rate cuts than Sydney and Melbourne, being more sensitive to other economic factors.

For example, between January 2001 and December 2002, interest rates declined by 1.5 per cent and Perth’s median house sale price increased 22.9 per cent. Sydney’s rose 44.5 per cent. Perth prices rose a modest 5.1 per cent between May 2019 and April 2021 when rates declined 1.4 per cent. Sydney and Melbourne prices increased 36.6 per cent and 28.7 per cent respectively.

When interest rates declined between January 2015 and December 2016, Sydney’s median house sale price rose 28.5 per cent and Melbourne increased 15.1 per cent but Perth declined 2.8 per cent. At this time WA was at the beginning of an extended economic downturn. People were leaving the state, population growth was low, unemployment was rising, and consumer sentiment was low.

We are at the start of another rate cutting cycle. The WA economy is strong, unemployment is low, and population growth remains strong. House prices have been increasing regardless of interest rates and, under current conditions, are likely to continue to do so. Over time, this cycle may boost the rate of growth.

However, we have also experienced a period of strong inflation. People have been impacted by the rising cost of living and a cycle where interest rates increased 13 times between May 2022 and November 2023. Consumers are cautious and home buyers are being prudent with their spending. Also, the urgency has left our market and this may minimise the impact of rate cuts.

Whether rates are rising or falling, if you are looking to buy a home it is important to buy what you can afford and not overextend yourself. If you have a home, use the rate cuts as an opportunity to pay more off your mortgage, build some equity and a buffer for the future.

Contact AZ Property for more insights about the market and learn more about current listings

Website: www.az-property.com.au

Phone: 08 9355 2757

Enquiry send to [email protected]

Source of the article: https://reiwa.com.au/the-wa-market/resources/articles/do-interest-rates-push-property-prices-up/?utm_source=sfmc&utm_medium=email&utm_campaign=250406_reiwa.com_newsletter_%23520&sfmc_id=2818226